Visit a nearby bank branch in your locality and collect information about various types of account available for customers to open as per their requirement.

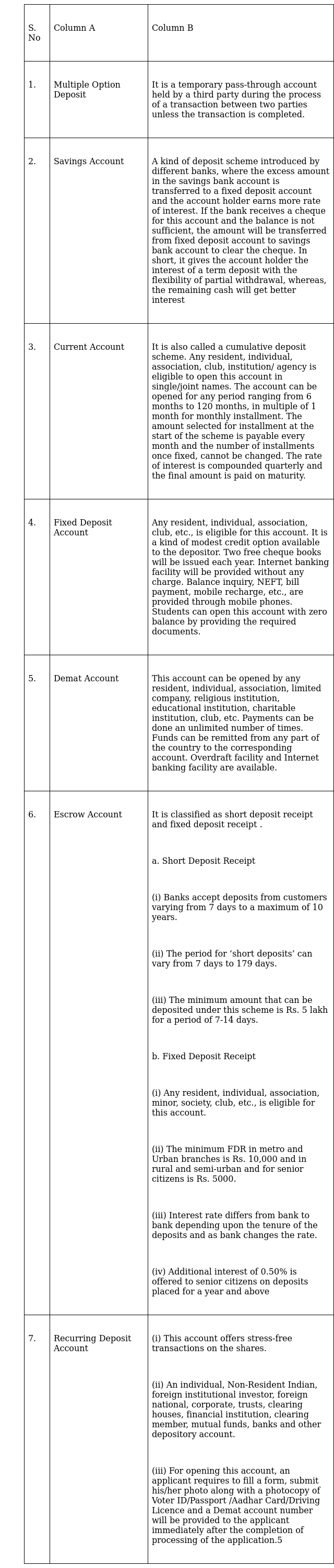

In the second part of the activity match the information given in column A with the information given in Column B.

The main function of a bank is to accept deposit from the public. There are three types of deposit:

i. Current account deposit: These deposits are the deposit which can be withdrawn to the extent of the balance at any time.

ii. Saving account: This account can be opened by any resident, individual, association, limited company, religious institution, educational institution, charitable institution, club, etc. Payments can be done unlimited number of times. Funds can be remitted from any part of the country to the corresponding account. Overdraft facility and Internet banking facility are available.The main aim of this type of account is to increase the habit of saving in individuals. The bank pays a rate of interest on the deposit held in these banks. This rate of interest is decided by the central bank of the country. There are certain restrictions on the number of withdrawals and the amount of withdrawals during a given period.

iii. Fixed account deposit: These deposits are also called time deposits as they are for a fixed period of time. The rate of interest given by the bank on this type of deposit account is higher than that of a savings account.

1. Multiple Option deposit - A kind of deposit scheme introduced by different banks, where the excess amount in the savings bank account is transferred to a fixed deposit account and the account holder earns more rate of interest. If the bank receives a cheque for this account and the balance is not sufficient, the amount will be transferred from fixed deposit account to savings bank account to clear the cheque. In short, it gives the account holder the interest of a term deposit with the flexibility of partial withdrawal, whereas, the remaining cash will get better interest

2. Saving account- Any resident, individual, association, club, etc., is eligible for this account. It is a kind of modest credit option available to the depositor. Two free cheque books will be issued each year. Internet banking facility will be provided without any charge. Balance enquiry, NEFT, bill payment, mobile recharge, etc., are provided through mobile phones. Students can open this account with zero balance by providing the required documents.

3. Current Account - This account can be opened by any resident, individual, association, limited company, religious institution, educational institution, charitable institution, club, etc. Payments can be done unlimited number of times. Funds can be remitted from any part of the country to the corresponding account. Overdraft facility and Internet banking facility are available.

4. Fixed Deposit - It is classified as short deposit receipt and fixed deposit receipt a. Short Deposit Receipt

(i) Banks accept deposits from customers varying from 7 days to a maximum of 10 years.

(ii) The period for ‘short deposits’ can vary from 7 days to 179 days.

(iii) The minimum amount that can be deposited under this scheme is Rs. 5 lakh for a period of 7-14 days.

b. Fixed Deposit Receipt (i) Any resident, individual, association, minor, society, club, etc., is eligible for this account.

(ii) The minimum FDR in metro and Urban branches is Rs. 10,000 and in rural and semi-urban and for senior citizens is Rs. 5000.

(iii) The interest rate differs from bank to bank depending upon the tenure of the deposits and as bank changes the rate.

(iv) Additional interest of 0.50% is offered to senior citizens on deposits placed for a year and above

5. Escrow account - It is a temporary pass-through account held by a third party during the process of a transaction between two parties unless the transaction is completed.

6. Demat account - (i) This account offers stress-free transactions on the shares.

(ii) An individual, Non-Resident Indian, foreign institutional investor, foreign national, corporate, trusts, clearinghouses, financial institution, clearing member, mutual funds, banks, and other depository accounts.

(iii) For opening this account, an applicant requires to fill a form, submit his/her photo along with a photocopy of Voter ID/Passport /Aadhar Card/Driving Licence and a Demat account number will be provided to the applicant immediately after the completion of processing of the application.

7. Recurring account: It is also called a cumulative deposit scheme. Any resident, individual, association, club, institution/ agency is eligible to open this account in single/joint names. The account can be opened for any period ranging from 6 months to 120 months, in multiple of 1 month for monthly installment. The amount selected for installment at the start of the scheme is payable every month and the number of installments once fixed, cannot be changed. The rate of interest is compounded quarterly and the final amount is paid on maturity.